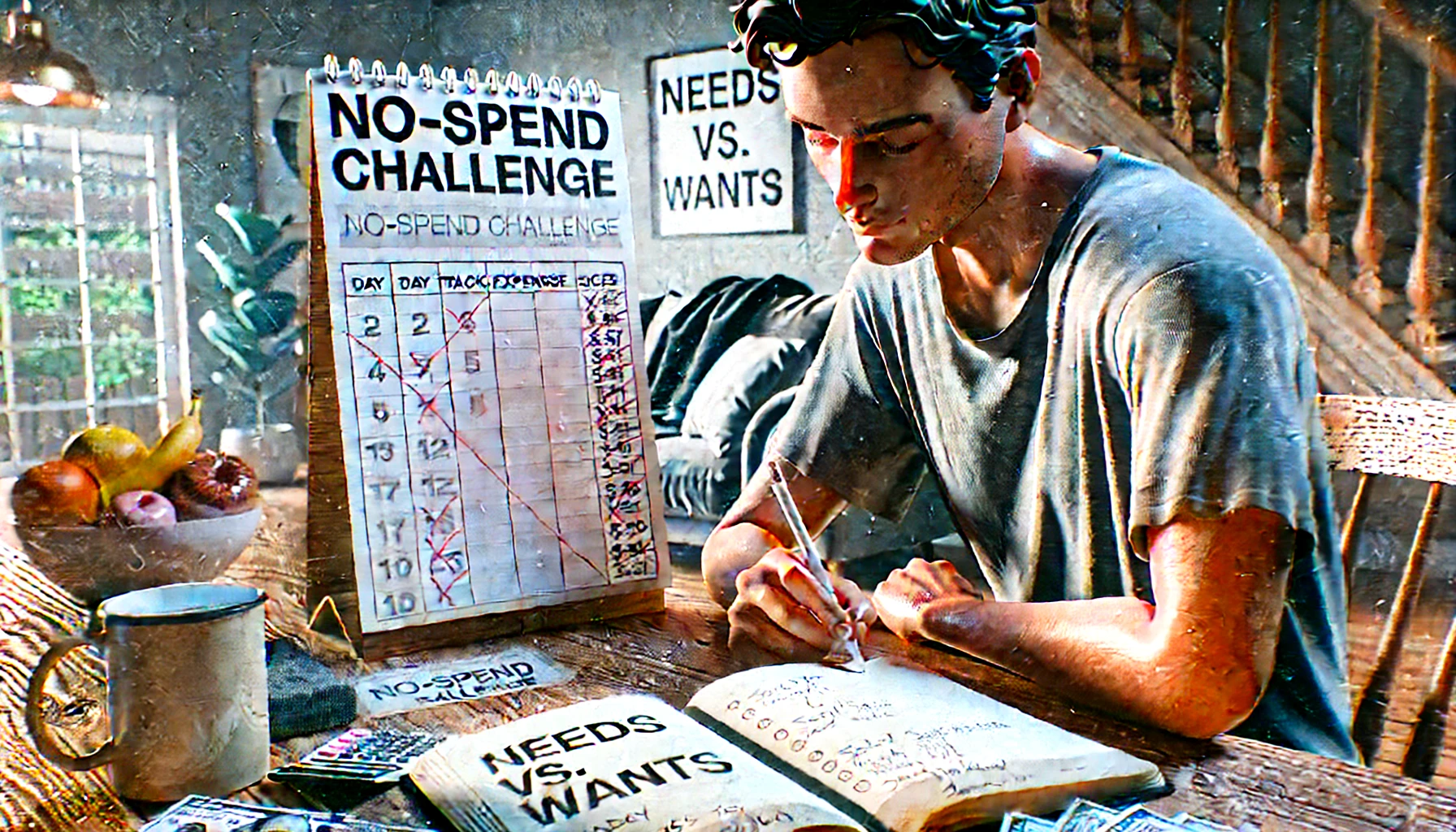

Feeling like your spending is out of control? Struggling to save even a little? A no-spend challenge might be exactly what you need to press pause, reset your habits, and get back on track.

It’s simple: you commit to not spending any money—except on essentials—for a set period of time. Whether it’s 3 days, 1 week, or even a full month, it’s one of the fastest ways to boost your savings and awareness.

In this article, you’ll learn how to run a successful no-spend challenge without feeling deprived or overwhelmed.

What Is a No-Spend Challenge?

A no-spend challenge is a short-term commitment to only spend money on absolute necessities like:

- Rent or mortgage

- Utilities

- Groceries

- Transportation

Everything else (eating out, shopping, entertainment, extras) is off-limits during the challenge.

Think of it like a “financial detox.”

Why It Works

A no-spend challenge helps you:

- Break bad spending habits

- Pause emotional or impulse purchases

- Increase savings quickly

- Gain clarity about your needs vs. wants

- Feel empowered about your money again

It’s not about punishment — it’s about purpose.

Step 1: Choose a Realistic Time Frame

Pick a length that feels challenging but doable.

Options:

- Weekend (great for beginners)

- 7 days (a solid reset)

- 30 days (for deep results)

You can also choose specific days (like “no-spend weekdays”) if you prefer flexibility.

Step 2: Define the Rules in Advance

Set clear boundaries so there’s no confusion mid-challenge.

Decide:

- What counts as a need (bills, groceries, gas)

- What counts as a want (takeout, clothes, Amazon orders)

- If any exceptions are allowed (pre-planned gifts, medical needs)

Write your rules down and share them with a friend or on social media for accountability.

Step 3: Prepare Before You Start

Success comes from planning ahead.

- Stock up on groceries or essentials (without going overboard)

- Cancel or pause subscriptions if needed

- Let friends or family know about your goal

Set yourself up to succeed—not struggle.

Step 4: Track Your Progress Daily

Each day, check in with yourself.

Ask:

- Did I stick to the plan?

- Was I tempted to spend? Why?

- How do I feel about my habits?

Use a simple tracker, calendar, or notebook to record your progress. Celebrating small wins keeps motivation high.

Step 5: Find Free Ways to Have Fun

No spending doesn’t mean no living.

Try:

- Game nights at home

- Cooking new meals from what you already have

- Nature walks or hikes

- Library books or movie nights

- DIY spa day or workouts

Get creative—it’s often more fun than you expect.

Step 6: Reflect on the Results

At the end of your challenge, take time to evaluate.

Ask yourself:

- What did I learn about my spending habits?

- What was harder than expected? What was easier?

- How much money did I save?

- What will I do differently going forward?

Use these insights to build better long-term habits.

Bonus Tip: Create a “Temptation List”

During your no-spend challenge, you’ll want things. That’s normal.

Instead of buying:

- Write it down on a “wish list”

- Wait until after the challenge to review it

Often, you’ll find you no longer want the item—or you’ll buy it more intentionally.

Final Thoughts: Spend Less to Live More

A no-spend challenge isn’t just about saving money—it’s about gaining control, rebuilding discipline, and remembering what really matters.

Start small, stay curious, and don’t stress over perfection. Every day you follow through is a win for your wallet—and your future.

You’ve got this.